Nic's weekly analysis #1 : Nakamigos

Are you curious about the Nakamigos project? Me too! The analysis of this week will be about it, here we go 👇 :

1-The fundamental :

Nakamigos is a collection of 20k PFPs created by HiFo Labs. The public mint took place on 23/03/23 at 12pm est.

As their website states, "nakamigos holders are granted the same commercial rights as Yuga Labs provided for cryptopunks".

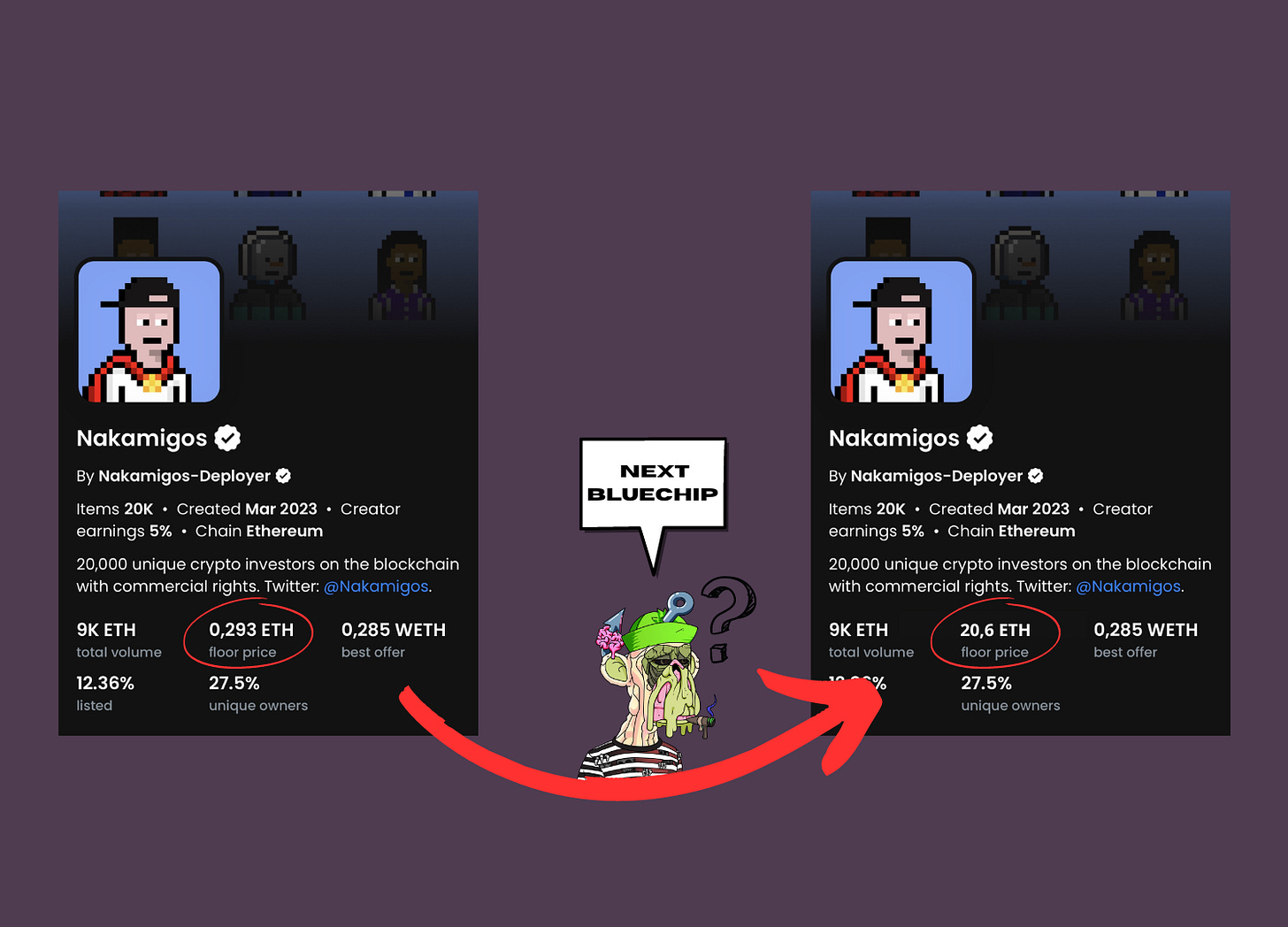

One could say that having the same commercial rights as a blue chip for less than 0.5 ETH is interesting.

Yes, but what is it to have the same rights as Cryptopunks holders? Simply the fact of having the image, nothing more! Nakamigos is a project that does not seem to have a great fundamental but is based on hype.

In my opinion, here are the 4 reasons for the pump of this project 👇:

Several whales buy a lot of them and resell them to create a large volume. Large volume = FOMO for beginners who buys seeing many people buying and seeing the floor amount from time to time.

The rumor that the project was created by "Larva Labs".

Some of their NFTs represent well-known personalities.

The Twitter hype created by influencers!

There are regular projects like that where whales play with to create volume and then resells all of a sudden, there was, for example, Owls recently, I will talk about it in a thread very soon on my Twitter.

2-Technical analysis :

However, very short-term project doesn't mean that you can't make a profit, that's the vision of "NFTNics", to make a profit on small projects without much interest to be able to invest in projects able to really change things. I myself have managed to find interesting entry points with the help of a coherent technical analysis 👇

I used a quite efficient strategy that I can explain here :

we spot a price for which there is a lot of listing above the floor price, I had for example spotted that there was a lot of listing at 0.1 ETH when the floor price was at 0.092. This usually means that it will be a small top

We wait patiently for the floor price to go down

When the listings are decreasing and the volume is increasing, is a good time to buy.

Well done! You managed to buy in a dip, which drastically reduces your chances of losses, now the objective is to find an interesting exit point adapted to your investor profile, I will not detail it here, I already talk about it in the ebook that I will release soon (stay tuned).

⛔ This strategy works ONLY when there is hype around this project on Twitter ⛔

3-The future of the project :

In my opinion, there is only a small percentage chance that the project will reach a new ATH but it is not impossible! Be careful because it is not very predictable in this kind of situation.

Here is what I have analyzed from this project! That's all for this week, thanks for reading this far, if you like this kind of content, let me know by subscribing to this newsletter for free.